Redeeming Your Savings Bonds – Here’s What You Need to Know

Today, savings bonds stand out as a steadfast option for many Americans. If you are pondering over the process of U.S. savings bonds redemption, you have landed on the right page. This guide will escort you through what U.S. savings bonds are, how they operate, and, crucially, how to redeem them.

Time / Essentially, U.S. savings bonds are government-issued securities that offer a risk-free way to save money.

You lend money to the U.S. government, and in return, it agrees to pay you back with interest after a certain period. Sounds straightforward, right? Well, they are! These bonds are hailed for their safety, making them a favorite among conservative investors.

How Do U.S. Savings Bonds Work?

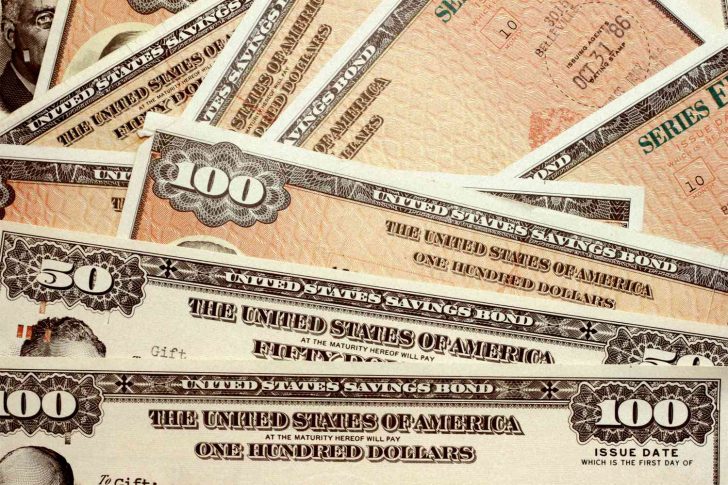

U.S. savings bonds work by paying interest that compounds semi-annually. There are two main types of savings bonds available: Series EE and Series I. Series EE bonds are purchased at face value and promise to double in value over 20 years. On the other hand, Series I bonds are inflation-indexed, meaning they offer a fixed rate plus an adjustment for inflation, making them an appealing choice during times of economic volatility.

Finance Corner / Series EE and Series I are the two major types. And your U.S. savings bonds redemption will be determined based on the types of bonds you have.

One of the perks of these bonds is their tax advantages. The interest earned is exempt from state and local taxes, and federal taxes can be deferred until you redeem the bond or it reaches maturity.

A Step-by-Step Guide to U.S. Savings Bonds Redemption

Now, let’s get to the heart of the matter: U.S. savings bonds redemption. Redeeming your bonds is a straightforward process, but there are a few key points to keep in mind.

Tax Considerations

Remember, the interest earned from U.S. savings bonds is subject to federal income tax, though it is exempt from state and local taxes. When you redeem your bonds, you will receive an IRS Form 1099-INT, which you must report on your federal income tax return.

Planning for this tax event can help manage any potential impact on your finances.

Know When to Redeem

Timing is crucial when it comes to redeeming your savings bonds. While you can cash in a bond after 12 months of purchasing it, doing so before it matures (usually 30 years) means you might miss out on additional interest earnings. Also, if you redeem your bond within the first five years, you will forfeit the last three months of interest as a penalty.

Marca / Before redeeming, it is wise to check the current value of your bond. You can easily do this online through the TreasuryDirect website by using their Savings Bond Calculator.

This step ensures that you are fully aware of how much you will receive upon redemption.

Where to Redeem Your Bonds?

Electronic bonds can be redeemed directly through the TreasuryDirect website, which is convenient and quick. For paper bonds, you can visit most local banks and financial institutions. It is a good idea to call ahead and confirm they offer this service. Be prepared to present identification.

However, if you are redeeming a bond that is not in your name, additional documentation may be required.

Why Redeem Your Savings Bonds?

The decision to redeem your savings bonds could be motivated by various reasons. Perhaps you need the funds for a significant purchase, educational expenses, or as part of your retirement strategy. Or maybe your bonds have matured. And it is simply time to cash them in.

So, whatever your reason, understanding the redemption process ensures that you can make the most out of your investment.

More in Loans & Mortgages

-

`

Curious About Travis Kelce’s Net Worth? Here’s the Scoop!

Travis Kelce’s name echoes through NFL stadiums, synonymous with athletic prowess and electrifying plays. But beyond his touchdown celebrations and record-breaking...

June 10, 2024 -

`

Everything You Need to Know About an Assumable Mortgage

What is an Assumable Mortgage? Whether you are a buyer or a seller, understanding the concept of assumable mortgages can open...

June 6, 2024 -

`

Layoff vs. Fired – Understanding the Crucial Differences

When it comes to job loss, understanding the distinction between being layoff vs. fired is crucial. While both situations result in...

May 30, 2024 -

`

When Are Business Taxes Due 2024? Essential Dates and Deadlines

Tax deadlines can be daunting, but fear not! Let’s break down everything you need to know to stay on top of...

May 22, 2024 -

`

How Much Does Jeff Bezos Make Per Hour? It’s More Than You Think!

Jeff Bezos, a name synonymous with innovation and wealth, stands as one of the world’s richest individuals. While Bernard Arnault and...

May 16, 2024 -

`

What is Portfolio Investment Entity (PIE) and How Can it Benefit You?

In the intricate world of finance, individuals seek avenues to optimize their investments while minimizing risks. One such avenue gaining traction...

May 9, 2024 -

`

What is a Bank Statement? Understanding its Definitions, Benefits, and Prerequisites

Ever wondered where your money goes? A bank statement is like a financial report card, giving you a clear picture of...

April 30, 2024 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

April 23, 2024 -

`

What Car Does Jeff Bezos Drive? Find Out Inside His Exclusive $20 Million Collection

Have you ever wondered what car does Jeff Bezos drive? This man’s tastes in vehicles are as expansive as his business...

April 17, 2024

You must be logged in to post a comment Login