Why Home Equity Loans are Booming in 2023

Home equity loans, also known as second mortgages, have become increasingly popular in recent years, and this trend is expected to continue in 2023. Several reasons for this boom include low-interest rates, a strong housing market, and an increasing demand for home renovation projects. Here are some reasons why home equity loans are becoming a popular financial tool for homeowners, along with the involved risks.

Low-interest rates

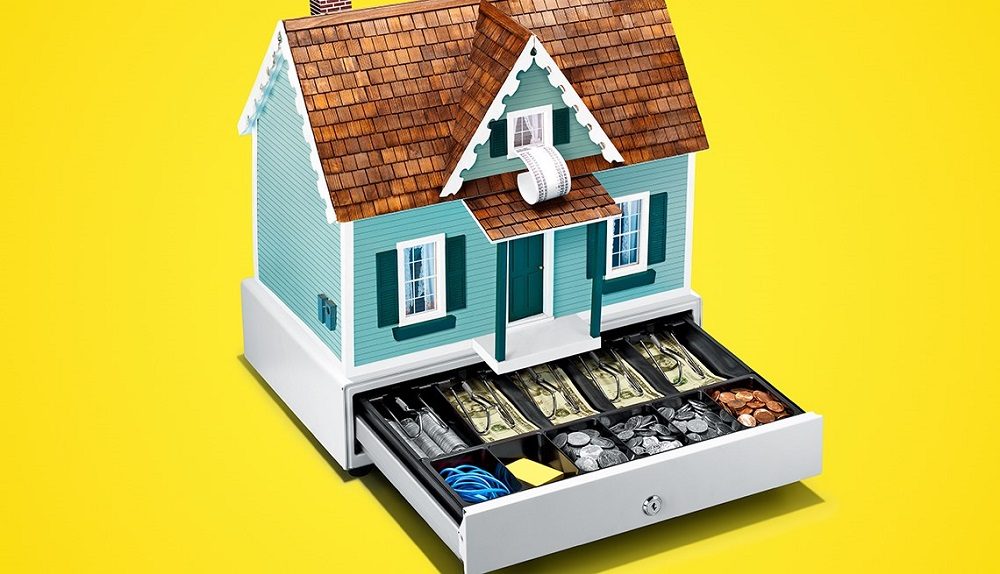

Pipa/ Shutterstock | Loans can allow you to tap into the equity of your home, but they carry risks

One of the main reasons for the growth in home equity loans is the current low-interest rates. The Federal Reserve has kept interest rates low in recent years to support the economy during the pandemic, making it an attractive time for homeowners to take out a home equity loan. With low-interest rates, homeowners can access a large amount of cash at a lower cost, allowing them to fund various projects, including home renovations, debt consolidation, and more.

Strong housing market

Another factor contributing to the growth in home equity loans is the strong housing market. The rise in home prices has increased the amount of equity homeowners have in their homes, making it easier for them to access this equity through a home equity loan. The robust housing market also means a greater demand for home renovations, driving the popularity of home equity loans for this purpose.

Increasing demand for home renovations

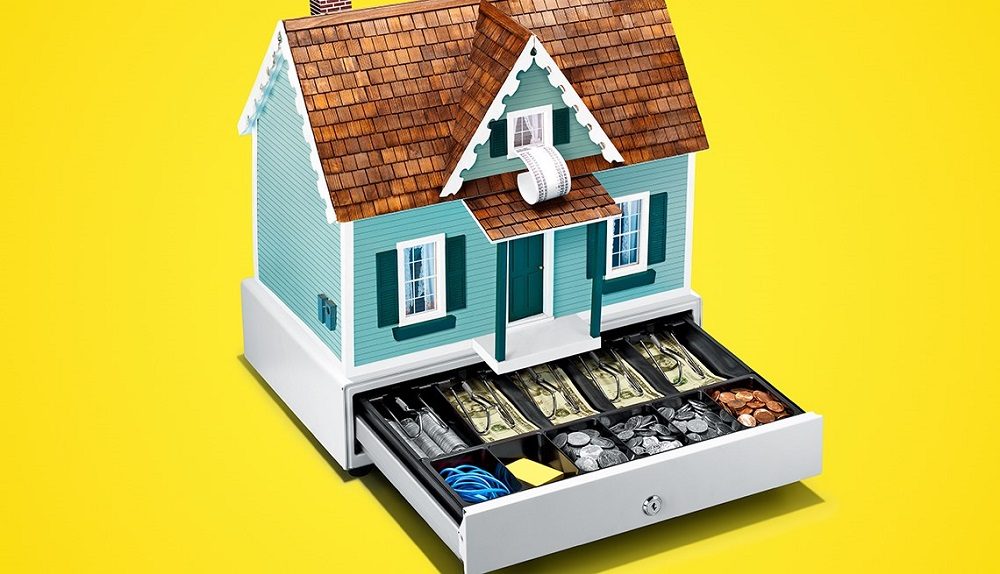

Mark Henricks/ Maxpexels | Home equity loans are heating up,

The increase in home renovation projects has also fueled the growth in home equity loans. Many homeowners are taking advantage of the low-interest rates and strong housing market to upgrade their homes, adding features like new kitchens, bathrooms, or outdoor spaces. Home equity loans are an attractive option for funding these projects because they allow homeowners to access the equity in their homes without having to sell or refinance.

Flexibility

Another reason for the popularity of home equity loans is their flexibility. Unlike other types of loans, home equity loans allow homeowners to use the funds for various purposes, including home renovations, debt consolidation, and more. Additionally, the interest on a home equity loan may be tax deductible, making it a more cost-effective option than other types of loans.

Ease of approval

Home equity loans are also becoming more popular because they are relatively easy to obtain. Unlike other types of loans, home equity loans do not require a lengthy application process or strict credit requirements. Homeowners who have built up a significant amount of home equity are often approved for home equity loans, making it a convenient and accessible option for funding various projects.

Investopedia/ Getty Images | Apart from mortgage loan, home equity loan is a good option when taking a loan

Risks and considerations

While home equity loans offer several benefits, it’s essential to be aware of the potential risks involved. One of the main risks is that your home may be foreclosed upon if you cannot repay the loan.

Additionally, taking out a home equity loan can increase your debt load and decrease your overall equity in your home. Before taking out a home equity loan, it’s essential to carefully consider your financial situation, your ability to repay the loan, and whether it’s the right choice for you.

More in Loans & Mortgages

-

`

Curious About Travis Kelce’s Net Worth? Here’s the Scoop!

Travis Kelce’s name echoes through NFL stadiums, synonymous with athletic prowess and electrifying plays. But beyond his touchdown celebrations and record-breaking...

June 10, 2024 -

`

Everything You Need to Know About an Assumable Mortgage

What is an Assumable Mortgage? Whether you are a buyer or a seller, understanding the concept of assumable mortgages can open...

June 6, 2024 -

`

Layoff vs. Fired – Understanding the Crucial Differences

When it comes to job loss, understanding the distinction between being layoff vs. fired is crucial. While both situations result in...

May 30, 2024 -

`

When Are Business Taxes Due 2024? Essential Dates and Deadlines

Tax deadlines can be daunting, but fear not! Let’s break down everything you need to know to stay on top of...

May 22, 2024 -

`

How Much Does Jeff Bezos Make Per Hour? It’s More Than You Think!

Jeff Bezos, a name synonymous with innovation and wealth, stands as one of the world’s richest individuals. While Bernard Arnault and...

May 16, 2024 -

`

What is Portfolio Investment Entity (PIE) and How Can it Benefit You?

In the intricate world of finance, individuals seek avenues to optimize their investments while minimizing risks. One such avenue gaining traction...

May 9, 2024 -

`

What is a Bank Statement? Understanding its Definitions, Benefits, and Prerequisites

Ever wondered where your money goes? A bank statement is like a financial report card, giving you a clear picture of...

April 30, 2024 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

April 23, 2024 -

`

What Car Does Jeff Bezos Drive? Find Out Inside His Exclusive $20 Million Collection

Have you ever wondered what car does Jeff Bezos drive? This man’s tastes in vehicles are as expansive as his business...

April 17, 2024

You must be logged in to post a comment Login